West Bengal Public Finance and fiscal Policy

West Bengal government’s finances are the worst among 5 highly-indebted states of India. the entire debt burden of province is near rupees two lakh crores implying that the debt burden of each citizen of the state is over twenty thousand rupees (The Times of India, May 30, 2011) that so is an dreadful figure. The Revenue deficit of the state is that the highest among the 5 highly-indebted states of Uttar Pradesh, Maharashtra, West Bengal, Andhra Pradesh and Gujarat. For the year 2009-10, revenue deficit (difference between revenue earnings and revenue expenditure) of the state stood at a staggering Rs 17,940 crore as compared to Rs 7,123 crore for Maharashtra.

West Bengal performed poorly in most parameters compared to the larger states, its performance during this area is even worse than the questionable backward states. That West Bengal government is on the bankruptcy is well recognized by these statistics. As such, it’s not unusual for one to need to travel deeper into the state of public finances of the nation’s fourth most inhabited states so as to examine however totally different indices of state finances have fared over the last 10 years about on get a clearer image of the particular plight of government finances. This paper primarily is driven by this would like and tries to investigate the behaviour of varied economic indicators in context of state finances therefore on give a somewhat candid exposition of province in terms of state finances.

Public Finances:

Structure of State budgets before exploring the trends of government finance of West Bengal over the last decade, one should briefly discuss concerning the fundamental structure of the state budget from that totally different parts are employed in our analysis. To the current finish, we start by lightness the main heads of the state budget in accordance to reserve Bank of India’s tips. Any budget, whether or not state or federal, is generally split into 2 parts or what one could decision 2 parallel accounts, namely, the Revenue Account and therefore the Capital Account

Revenue Account

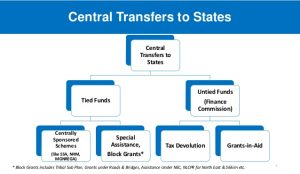

Revenue receipts generally contain tax receipts and non-tax receipts. Total government revenue consists of state’s own tax revenue and therefore the part of central tax receipts that’s shared by the states. Non-tax revenue, similarly, contains of state’s own non-tax revenue and grants from the centre that are received by the state. The pool of state’s own tax revenue is created primarily through 3 broad sources, namely, taxes on income, taxes on property and capital and taxes on commodity and services. Every of those classes may be classified more. Taxes on income is that the summation of agricultural income tax and taxes on professionals, trades, callings and employment. Taxes on property and capital dealings embrace land revenue, stamps and registration fees and concrete property tax.

Capital Account Total Capital receipts contains the subsequent major categories: external debt, internal debt, loans and advances from the centre, recovery of loans and advances, inter-state settlement, contingency fund, tiny savings and provident funds, reserve funds, deposits and advances, suspense and alternative miscellaneous things like deposits with RBI, appropriation to contingency fund, alternative miscellaneous capital receipts, and remittances. Total capital disbursements on the opposite hand is that the summation of the subsequent items: Total Capital outlay (development and non development capital expenditure), discharge of internal debt, repayment of loans to the centre on account of varied loans and grants received towards central set up schemes

Indicators of fiscal Performance to investigate the trend and current situation of state finances of the country one should first identify a stingy set of fiscal indicators which might ably replicate the condition of finances of the state. On a gross level, to understand the whole receipts of the state one may use the indices like Total revenue receipts and total capital receipts as a proportion of net State Domestic Product (NSDP). A additional micro level analysis but would demand performance of various parts of, especially, the revenue receipts as a proportion of NSDP, like movement of total tax revenue, own tax revenue, non-tax revenue etc.

On the fiscal front, there has been some easing in recent years. The State’s fiscal deficit (as a proportion of the GDP) declined from 4.1 per cent in 2010-11 to 3 per cent in 2014-15, and therefore the revenue deficit from 3.6 per cent to 1.3 per cent. The debt-to-GDP ratio conjointly improved from 40.7 per cent to 34.3 per cent throughout this era. it was in July 2010 that province created the primary step towards enacting the fiscal Responsibility and Budget Management Act.

But, a lot of remains to be achieved. As other States have completely eliminated revenue deficit, province still runs a deficit on this count. Its fiscal deficit is additionally on top of the all-States average. With expenses overshooting revenue over the years, the authorities have been on a borrowing spree: therefore the flight debt. Concerning one-fifth of the State’s disbursement on the revenue account is on interest payments.

A large a part of the matter lies within the failure of the CPI(M) government to lift decent tax revenue throughout its tenure. And there has been no vital modification since the TMC took over, means consultants. The State’s own tax revenue-to-GDP ratio, though’ up from before, continues to be below the all-States average of half-dozen.6 per cent. This can be as a result of a bit of the State’s growth is accounted for by Services, and therefore the informal phase at that, that doesn’t fall inside the tax web. This includes the schooling trade, tiny restaurants, hotels and roadside vendors. Heavy these is so important, however a political situation.

On expenditure too, the file of both the Left and the TMC has been some distance from marvellous. Data display that the States’ social area spend as a percent of its GDP averaged five according to cent at some point of 2004-08 and 6.3 in line with cent all through 2008-10, decrease than that for similar States. While the ratio went up to six.6 according to cent during 2012-14, it changed into nevertheless under the similar State average.

Likewise, the State’s capital outlay as a percentage of its GDP averaged 0.8 consistent with cent at some stage in 2004-2010, as against the similar State common of 2.4 consistent with cent. It changed into at 0.8 according to cent in 2012-13 too before it rose to 1.Three per cent in 2013-14. But, this was decrease than the similar State common.